- Edukasyon

- Mga Diskarte sa Pakikipag-trade

- Pabaliktad na Diskarte

Reversal Strategy

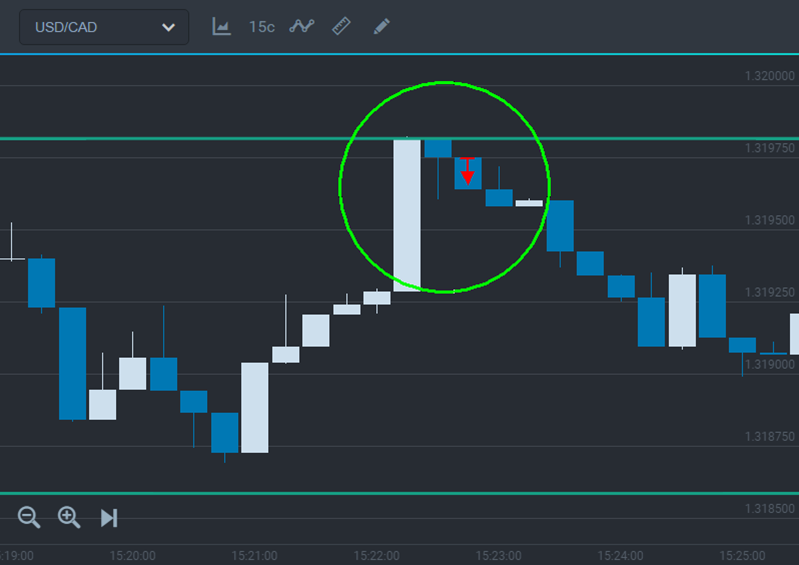

The core of this strategy involves initiating a trade after a reversal in price movement. A valid trading signal occurs when a candlestick reaches a level but fails to close outside it. This can happen with either the shade or body of the candlestick touching the level. If a candlestick's shade breaks the strength level but closes within it, it indicates the price's inability to break out. Confirming this signal requires observing a subsequent candlestick that moves in the opposite direction, confirming the reversal.

What to do after you see this signal:

1) A candlestick was not able to be closed outside the level and touched it with its shade or body.

2) Wait for a confirmation — when the second candlestick bounces off the level.

3) Trade online in the reverse direction.

Buying a put if the price bounces off a resistance level

Buying a call if the price bounces off a support level

Buying a call if the price bounces off an ascending trend line

Sell if the price bounces off an ascending channel line

Keep in mind that while there may be numerous support and resistance levels on the chart, only those confirmed by price action will truly impact future prices. To assess the strength of a level, examine the price history and observe how frequently the price halted or reversed at that particular level. If the price has consistently overlooked the level, there's no need to factor it into your analysis. Stick to the levels that have demonstrated significance through historical price behavior.